UAE New Dirham Symbol: Impact on Accounting, Invoicing & Finance

The United Arab Emirates has introduced a new currency symbol for the dirham (AED), marking a historic update to the nation’s currency identity.

Launched in March 2025, this symbol is expected to appear in both physical and digital currency contexts, reflecting the UAE’s vision for a modern financial system. For small and medium businesses (SMEs) in the UAE – which make up around 94% of companies and 63.5% of the UAE’s non-oil GDP – it’s essential to understand what this change means and how to adapt. In this guide, we’ll break down the new dirham symbol’s design, purpose, and impact on everyday business activities, including invoicing in UAE currency, accounting processes, and future digital currency plans.

Table of Contents

ToggleIntroducing the New UAE Dirham Symbol (March 2025)

Official Launch: The Central Bank of the UAE (CBUAE) unveiled the new dirham symbol on 27 March 2025 in Abu Dhabi.

This launch coincided with the UAE joining the FX Global Code, underlining a commitment to best practices in the foreign exchange market and elevating the dirham’s status globally.

The UAE is the first Arab country to introduce such a currency symbol, aiming to make it as universally recognized as the dollar’s “$”.

Design and Appearance

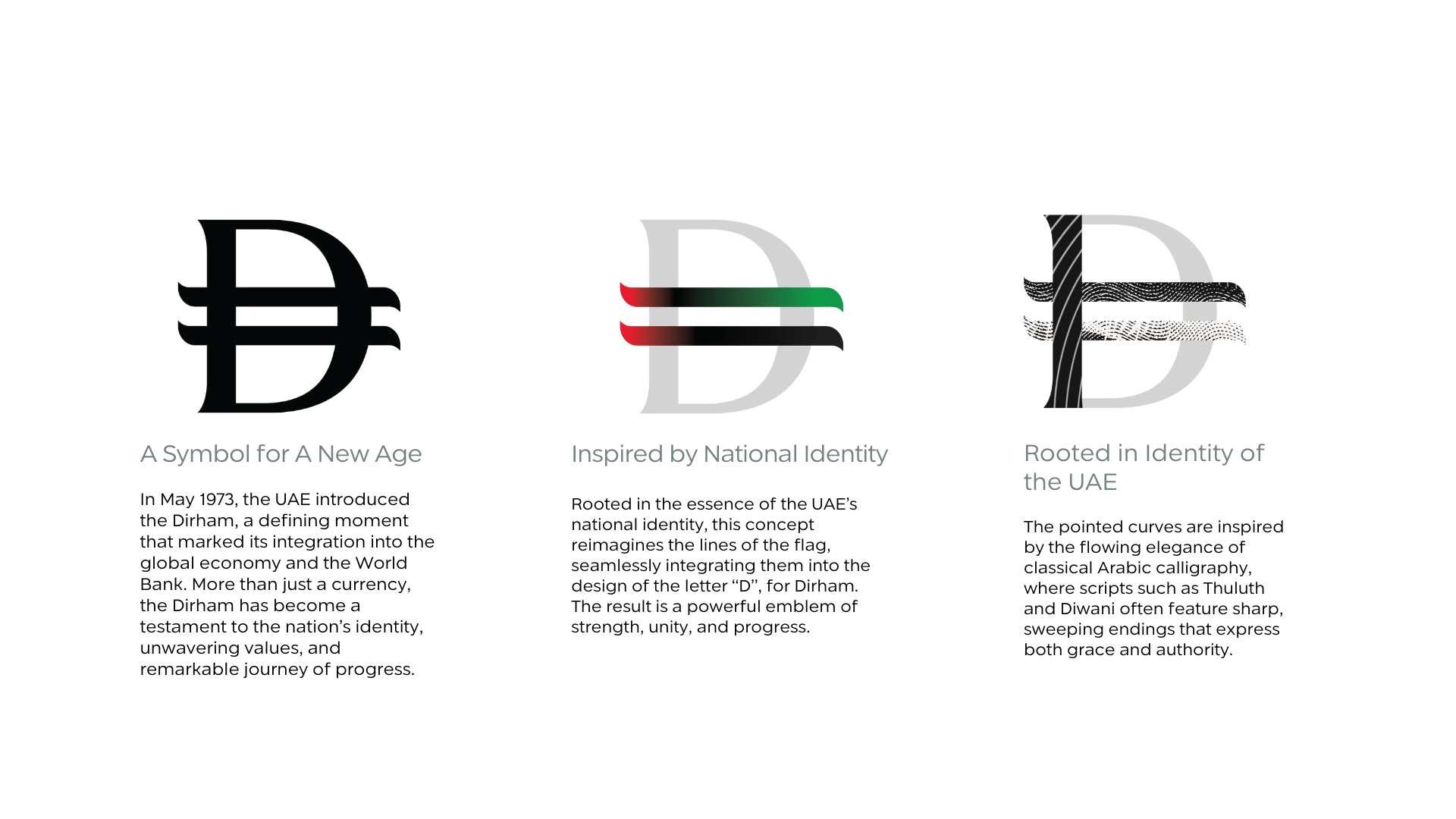

The symbol is derived from the English letter “D”, representing “Dirham,” and it features two parallel horizontal lines through it.

This style echoes other currency symbols (for example, the euro’s lines) and is rich in meaning. The two lines signify financial stability – conveying the strength and balance of the UAE’s currency.

The design also draws inspiration from the UAE flag’s colors and elements, symbolizing national pride and unity.

In practice, the main symbol is typically rendered in black for standard use, while a special variant for the upcoming digital currency is depicted with the UAE flag colors encircling it.

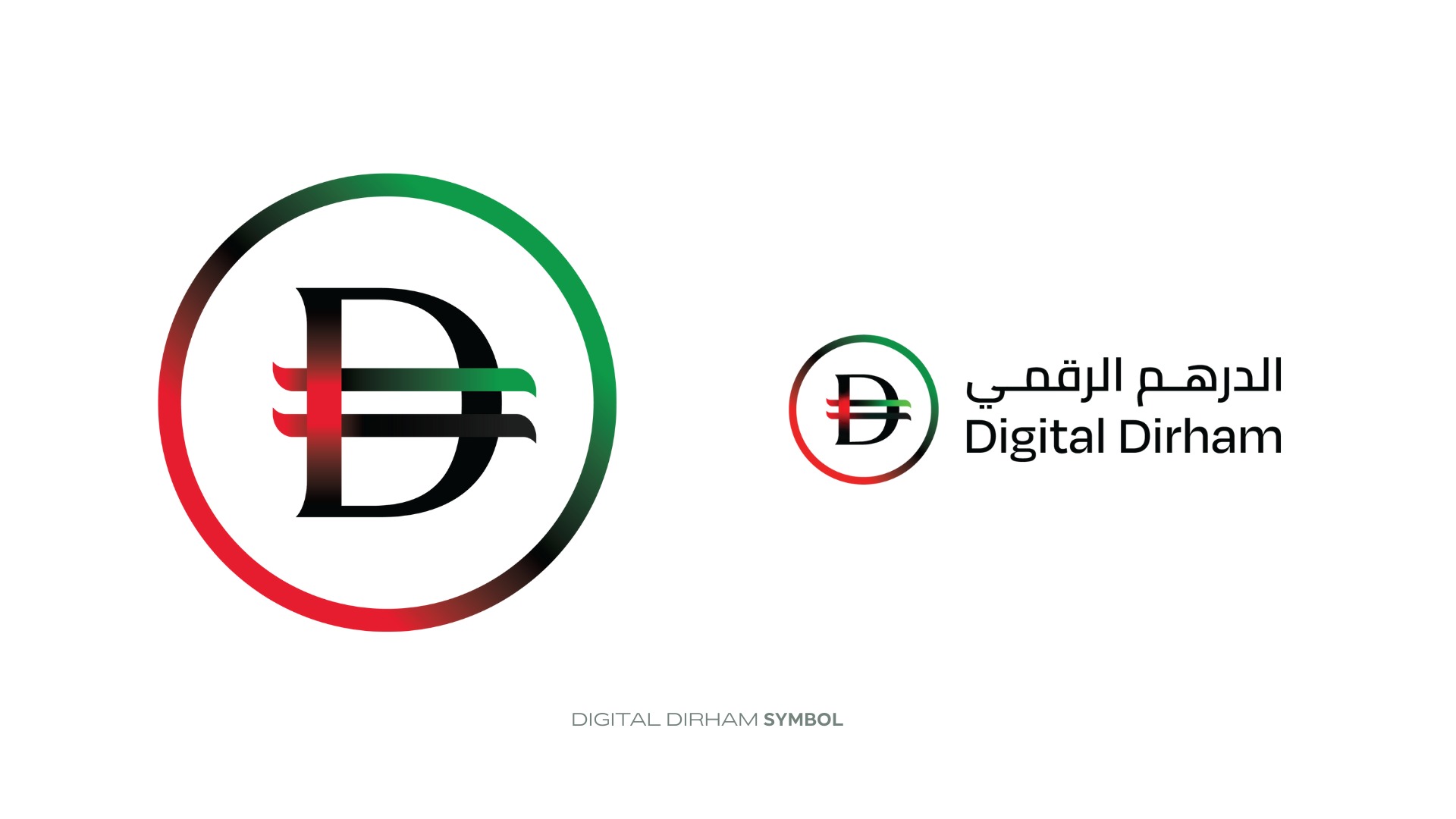

Physical vs Digital Forms

The same symbol represents the dirham in both its physical form and future digital form. The digital version of the symbol is shown with a circular emblem and the national colors to distinguish it, highlighting the UAE’s modernity and the Digital Dirham initiative.

This unified branding means that whether a transaction is in cash or in the forthcoming digital currency, it will be identifiable with one common icon of the UAE dirham.

Why Introduce a New AED Symbol?

The introduction of the new AED symbol comes with several strategic goals:

Global Currency Positioning: One key aim is to strengthen the UAE dirham’s positioning as an international currency.

By giving the dirham a unique and recognizable symbol, the UAE makes it easier for global markets to identify and trust the currency. This is part of a broader effort to promote the UAE as a leading global financial hub and to integrate with international financial systems.

National Identity and Pride: The symbol serves as a logo for the nation’s currency, encapsulating national identity. Its design roots in the UAE flag demonstrate pride in the country’s heritage and future. Officials have described the emblem as “a powerful emblem of strength, unity, and progress” that reflects the vision of UAE’s leadership.

Modernization and Digital Economy: Launching a new symbol also signals the UAE’s leap toward a digital economy.

FX Global Code and Best Practices: The timing of the symbol release, together with adopting the FX Global Code, underlines a push for transparency and ethical standards in currency exchange.

In short, the new symbol is not just a graphic update – it’s a strategic step to boost the dirham’s global recognition, local pride, and digital readiness.

Using the New Dirham Symbol in Business Operations

SMEs should start thinking about where and how to use the new currency symbol in their day-to-day operations. Here are some practical guidelines and considerations:

Price Tags and Signage: For retail and customer-facing businesses, consider updating price tags, menus, and signage to display the new symbol instead of “AED”. For example, a price previously shown as “AED 100” can now appear as “Ⓓ 100” (Note: Ⓓ is used here as a placeholder to represent the official new UAE Dirham symbol until Unicode integration is finalized).

The Central Bank’s usage guide advises placing the symbol to the left of the amount, separated by a space (even when using right-to-left layouts like Arabic). For instance, write it as “Ⓓ 100” not “100Ⓓ”.

Invoices and Receipts: Using the sign on invoices, receipts, and purchase orders is quite appropriate. If your template calls for a currency column or text, change it to the symbol for a polished appearance. Some companies decide to show both the symbol and “AED” for clarity—e.g., “Ⓓ 1,000 AED”—during this transition time, but this might not be required going forward as familiarity increases.

Contracts and Legal Documents: In formal documents, you might still see “AED” used (and you can continue to use it to avoid any confusion or legal ambiguity). If you use the symbol in contracts, you might add in parentheses “(AED)” at first mention, just to be explicit. Remember, the symbol is a visual alias for the currency – it holds the same meaning as writing AED.

Dual Language Considerations: In Arabic documents, the currency has traditionally been denoted as “د.إ”. The new symbol is mostly based on a Latin character “D,” so its use may be more frequent in English context. Arabic content might keep using “د.إ” for now, but the symbol could finally be used in Arabic books as well (just like the dollar “$” is accepted worldwide). Keep an eye on the official guidance on using the sign in Arabic publications; when in doubt, complement it with the Arabic abbreviation in the interim.

Businesses help to mainstream the use of the symbol by including it into public-facing publications. This not only fits UAE’s direction but also offers your documents an updated look.Customers will soon start recognizing the new emblem, and using it proactively can demonstrate that your business stays current with national developments.

Updating Your Systems and Software (Keyboards, Accounting, Platforms)

A key consideration for businesses is how to actually type and print the new dirham symbol. Being a brand-new character, it will take some time to be fully integrated into all systems:

Keyboard Availability: As of April 2025, standard keyboards do not yet have a dedicated key for the new symbol. Since the symbol was just introduced, it is not yet part of the Unicode standard (the universal library of characters for computers).

As of April 2025, the symbol has not yet been assigned a Unicode character code, which means it must be manually inserted or used as a graphic asset.

The UAE Central Bank has provided digital assets (like font files and vector images) for the symbol.

In practice, this means you might need to copy-paste the symbol from an official source or insert it as a special character in your documents until operating systems add it in a future update. We can expect in upcoming months that popular operating systems (Windows, macOS, mobile keyboards) will include the symbol once it’s approved in Unicode, at which point a simple keyboard shortcut will likely become available.

Accounting & Invoicing Software: Most accounting software allows custom currency symbols or will update their currency list via patches. Check with your software provider (such as QuickBooks, Zoho Books, SAP, etc.) about support for the new UAE dirham symbol.

Point of Sale (POS) Systems: Retailers should contact their POS providers to ensure receipts can print the new symbol. This might involve a minor software update. Given that the symbol is brand new, some receipt printers might print a placeholder or question mark if they encounter an unknown character.

Online Platforms and Websites: If you display prices on a website or e-commerce platform, you’ll want to use the new symbol for the AED currency. This might require adding the symbol as an icon next to prices (via an <img> tag or icon font) until web fonts universally support it.

Document Templates: Update templates in Word, Excel, or other tools for invoices, purchase orders, or financial statements. You can find the official vector image or font of the symbol provided by CBUAE– incorporating this into your templates will allow you to add the symbol as needed.

Impact on Invoicing, Accounting, and Compliance

For most SMEs, adopting the new symbol is straightforward and carries no direct financial cost – it’s a change in notation. However, it’s worth noting a few impacts on business processes:

Accounting Records: Internally, your accounting records might still use AED as the currency label (which is fine). You may start seeing the symbol in bank statements or reports from 2025 onward. Ensure your finance team recognizes that “Ⓓ” is the same as AED. This is more of a training/awareness point than a procedural change.

Tax Invoices: The UAE’s Federal Tax Authority (FTA) thus far has accepted invoices with “AED” as the currency. The new symbol should be equally acceptable since it clearly denotes the UAE dirham. As of now, the Federal Tax Authority has not issued any directive requiring the symbol on tax invoices, and using either ‘AED’ or the new symbol is accepted, as long as the currency is clear.

Just be consistent; using the symbol is compliant as long as it refers unambiguously to the UAE dirham. If in doubt, you can suffix the first occurrence with “(AED)” as mentioned. We anticipate that FTA and other bodies will issue guidance if needed, but as the symbol is a government-driven change, its use is being encouraged, not restricted.

Cross-Border Transactions: When dealing with international partners or banks abroad, be mindful that they might not immediately recognize the new symbol. In cross-border invoices or communications (at least in 2025), it might help to include “AED” in addition to the symbol to avoid any confusion – e.g. “Ⓓ 5,000 (AED 5,000)”.

This is similar to how some documents list both a currency name and symbol during transitions. Over time, as the symbol gains international recognition (the plan is for it to be used internationally to promote the currency), this extra clarification won’t be necessary.

Legacy Documents and Systems: You do not need to go back and change old records. Past financial statements or historical contracts listing “AED” remain valid. There’s no requirement to retroactively update anything. Focus on implementing the symbol for new documents moving forward. Think of it like a new logo – old documents keep the old logo, new ones use the new branding.

Compliance and Auditing: Auditors and compliance officers will likely treat “Ⓓ” as equivalent to “AED” in reviewing documents. The key is internal consistency and clarity. To be safe, you can mention in your accounting policies or notes that “the symbol Ⓓ is used to denote amounts in UAE Dirhams (AED)” so that anyone reading financial reports understands this. This note only needs to be temporary until the symbol is universally understood.

Overall, the impact on accounting and compliance is minimal – it’s mainly about adapting to a new convention. No accounting standards change, and your financial reporting (like in Dirhams on balance sheets or income statements) remains under the same currency, just potentially with a new symbol in print. Many businesses are treating the first few months of this change as a transition period where both “AED” and the new symbol are used side by side. By the end of 2025, we expect the symbol to be commonplace in all business materials.

Steps for SMEs to Adapt to the New Currency Symbol

To ensure a smooth transition, here are some actionable steps your business can take:

Educate Your Team: Inform your finance department, cashiers, sales team, and anyone who handles documents about the new dirham symbol. Ensure they know that Ⓓ represents AED, and share some examples. A quick internal email or a short training session can prevent any confusion.

Update Templates and Stationery: Go through your standard templates (invoices, quotations, letterheads with price mentions, etc.) and insert the new symbol where appropriate. If you have pre-printed stationery with “AED” and can’t change immediately, it’s fine – deplete old stock while planning for updated designs in the next print run.

Check Software Settings: As noted, update your accounting software settings to see if the symbol can be enabled. Look for currency display options. If an update is needed, schedule it with your IT or software vendor. Don’t forget to update point-of-sale systems or any other billing systems you use.

Communicate with Stakeholders: Let your clients and suppliers know that you’ll start using the new symbol. This can be as simple as a note on an invoice or a newsletter mention: “Please note, we are now using the new official UAE dirham currency symbol (Ⓓ) on our documents. This symbol represents AED, the UAE Dirham.” This heads-up will reduce questions and also demonstrates your company’s compliance with new standards.

Monitor for Official Updates: Stay tuned to communications from the Central Bank or UAE government. They may release additional guidelines, keyboard shortcuts, or announce when the symbol is added to Unicode (which will simplify digital usage). Being aware will help you update processes at the right time. Reliable news sources and the Emirates News Agency (WAM) are good channels to follow for such updates.

Plan for the Digital Dirham: While updating for the symbol, also start thinking ahead about the digital dirham UAE initiative. The Digital Dirham (CBDC) is expected to roll out in late 2025.

Businesses might eventually handle digital currency transactions alongside conventional ones. Ensure your accounting and CFO services advisors are planning for this. For now, it could be as simple as adding a line in your policy that says you accept payments via digital dirham when it becomes available.

Seek Professional Support if Needed: If all of this sounds technical or time-consuming, remember you don’t have to do it alone. Consider consulting with accounting UAE professionals or outsourced CFO services.

By taking these steps, your SME can quickly adapt to the new symbol with minimal disruption. Early adoption also signals that your business is agile and up-to-date, which can be a positive message to partners and customers.

The New Symbol and the Digital Dirham

It’s worth putting this symbol introduction into the context of the UAE’s broader financial transformation – notably the upcoming Digital Dirham (the UAE’s central bank digital currency). The new symbol is a bridge between the old and the new forms of money. Here’s how it fits into the bigger picture:

Digital Dirham Launch Timeline: The CBUAE has fast-tracked its plans for a central bank digital currency. The Digital Dirham is expected to launch for retail use by late 2025 (Q4 2025).

Integrated Symbol for Both Currencies: The introduction of a single symbol for both physical and digital dirham ensures there’s no divergence in how value is represented.

Legal and Regulatory Readiness: CBUAE has announced its intention to recognize the Digital Dirham as legal tender upon official rollout. The legal and regulatory framework is expected to be fully aligned by launch.

This means when it launches, businesses can legally accept it for any transaction just as they would accept cash. There may be new regulations or guidelines on how to handle digital dirham transactions (for accounting, VAT, etc.), but they will likely parallel existing cash handling rules.

Conclusion

Taking in these developments will give SMEs competitive benefits. Early adopters of digital payments and modern invoicing systems frequently appeal to a larger client base (especially younger, tech-savvy ones). The UAE government’s drive toward a digital economy could also come with incentives or support for companies that react swiftly.

Those SMEs who understand and apply these changes will be positioned to flourish in the changing accounting scene of UAE 2025 and beyond.

CTA: Trust Accounts Management offers accounting services, CFO and compliance & setup support that can guide you through implementing changes like these seamlessly. Getting expert help can save time and ensure nothing is overlooked during the transition.

Sources:

u.ae

centralbank.ae

arabnews.com

finews.com

rizmona.com

one-fs.com

FAQ

1. Why did the UAE introduce a new Dirham symbol?

As with the dollar, the euro, or the pound, the United Arab Emirates (UAE) has introduced the new Dirham sign (Ⓓ) in order to give the national currency a unique visual character. Increasing global awareness, strengthening economic confidence, and aligning with the nation’s growing digital and financial footprint are all achievable goals that can be accomplished through this step.

2. How will the new AED symbol affect accounting and bookkeeping software?

Small changes in accounting and bookkeeping tools will help the new symbol to be supported. Most current systems will provide updates or patches including it to guarantee seamless reporting, invoicing, and compliance across financial records.

3. Will invoicing platforms need to be updated with the new Dirham symbol?

Indeed, invoicing platforms will have to include the new symbol in output PDFs, templates, and currency settings. The good news is that most systems are already working on flawless integrations to maintain user business-as-usual.

4. When will the new Dirham symbol be mandatory in financial systems?

Adoption is encouraged, but there is currently no legal obligation or enforcement timeline. Regulatory authorities are supposed to offer a transition period, therefore providing businesses plenty of time to change without disruption.

5. Do small businesses and freelancers need to update their systems?

Absolutely—but there’s no need to stress. Updating invoice templates, websites, and accounting software ensures consistency and keeps your business aligned with UAE’s evolving financial standards.

6. What industries will be most affected by the new Dirham symbol?

First to feel the change will be industries significantly involved in financial transactions, such as accounting, retail, banking, and e-commerce. Everyone from freelancers to corporates will eventually incorporate the new sign into their daily activities, nevertheless.