UAE Corporate Bank Account: Documents & Hurdles

Table of Contents

ToggleIntroduction

If you’re setting up a business in the UAE (mainland or free zone), getting a corporate bank account isn’t optional. If your company will invoice customers, pay staff, or hold funds in the UAE, a corporate bank account becomes essential because banks and regulators expect proper corporate banking for most UAE businesses.

This blog walks you through exactly what banks will ask for, the common pain-points, typical timelines in 2025, and what you can do to avoid delays or rejection. By the end you’ll know what to expect and how to be ready.

Who needs a corporate bank account in UAE

You’ll likely need a corporate bank account if your business falls into one of the following categories:

- A Mainland business setup registered under a UAE Economic Department is generally required by banks and regulators to operate through a corporate bank account for business transactions

- A Free-zone company: registered under a free zone authority (e.g. one of many free zones in UAE), even if fully foreign-owned.

- Foreign-owned entities or branches usually require a UAE corporate account, provided they submit legalised parent-company documents and complete full beneficial-ownership disclosure.

(*Note: Subject to bank approval and enhanced due diligence)

- In some cases, sole proprietors or freelancers (depending on banking policies), though banks treat those differently than corporate entities. Eligibility and requirements vary significantly by bank and licence type.

Here’s what this means in practice: if your company is formally registered, whether in mainland or free zone and plans to invoice, collect, or disburse funds in AED or other currencies, a corporate bank account is the logical (and often required) route.

The Central Bank of the UAE requires banks to apply customer due-diligence and AML checks when onboarding corporate customers, which is why they request detailed company, identity, and ownership documents.

Documents & information required

Let’s check the breakdown of what banks will almost always ask for and what you should prepare.

Core company documents

- Valid Trade Licence or Commercial Registration (issued by the mainland authority or Free Zone Authority).

- Certificate of Incorporation or Company Registration Certificate / Company Extract.

- Memorandum and Articles of Association (MOA / AOA) or Shareholders Agreement that defines ownership structure.

- Share Certificates or the official Shareholder Register issued by the licensing authority.

- Board Resolution or Power of Attorney authorising the account opening and naming account signatories. Necessary when signatories differ from shareholders or directors.

Identity & beneficial-ownership information

- Passport copies of all shareholders, directors, and authorised signatories.

- If resident in UAE: Emirates ID and UAE residency visa copy for shareholders or signatories.

- A UBO (Ultimate Beneficial Owner) declaration, as required under UAE AML and CDD regulations, showing the individuals who ultimately own or control the company.

Proof of business presence & address

- Tenancy contract (e.g. Ejari in Dubai) / lease agreement or office rental agreement showing you have a legitimate UAE business address.

- Utility bill or other proof of address if tenancy isn’t available or if required by bank.

Business activity, financial background & due diligence documents

Depending on the bank and the profile of your business setup (startup, foreign-owned, no revenue yet, high-risk industry), you may also need:

- Business plan or company profile, describing business activity, intended operations, and financial/transaction projections.

- Past bank statements (personal or corporate), many banks ask for 6–12 months of statements for shareholders or directors, especially for non-residents or companies without operating history.

- Client or supplier contracts, invoices, or documentation showing genuine business activity, especially for newly formed companies, to prove that the company isn’t just a shell.

- Bank reference letters (from existing banks in home country or elsewhere), if requested, banks sometimes ask for references for shareholders or corporate group.

Compliance & regulatory paperwork

- Full compliance with KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements, as per CBUAE-mandated procedures.

- For entities owned by other companies: notarised/legalised corporate documents of parent entities, and full ownership chain disclosure.

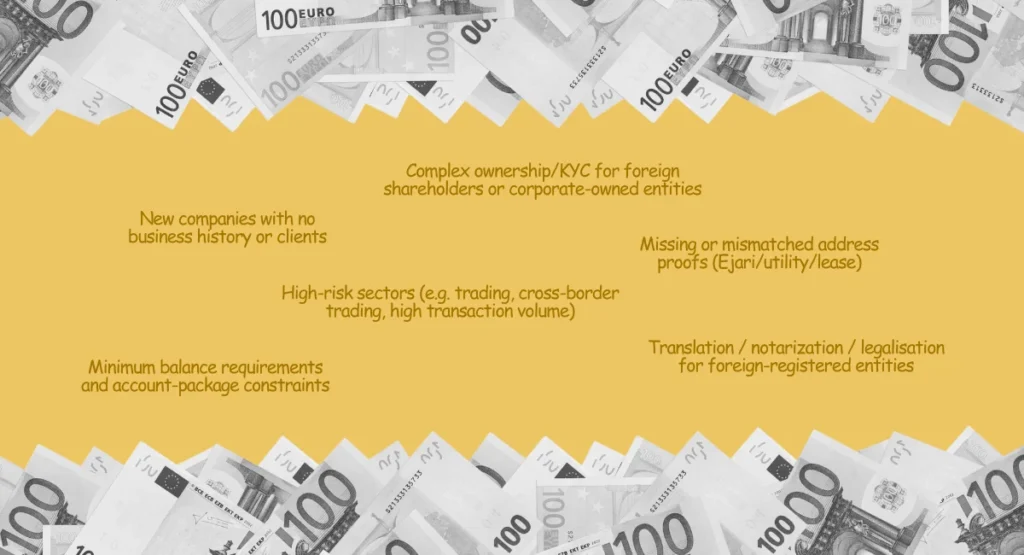

Typical Hurdles & Common Delays

Here’s where many entrepreneurs get stuck.

Timeline & expectations

Here’s a realistic view of what to expect in 2025, depending on how prepared you are and your company profile.

- For a straightforward case with complete documents, approvals often take 2–4 weeks. Applications involving foreign shareholders, non-resident signatories, or document legalisation typically take 4–8 weeks. High-risk sectors or complex ownership structures can require 6–12 weeks or longer due to enhanced CDD checks.

- For companies with foreign shareholders, complex ownership structures or minimal business history: 4–8 weeks is common. Banks often need extra time for KYC/AML and document legalisation.

- For high-risk sectors or non-resident companies without UAE presence: 6–12+ weeks, possibly longer if additional compliance or documentation is needed.

(*Note : These timelines are indicative and vary by bank, risk profile, and internal compliance review)

In practice this means funds, from investments, overseas transfers, investor money or sales could get stuck waiting. Payrolls, supplier payments, import/export operations may stall.

If your business depends on timely cash flow (e.g. procurement for projects), delays in banking setup can have real operational impact.

Tips & best practices

Here’s how to make the process smoother.

- Prepare a complete, clean set of documents, trade licence, MOA/AOA, share-register, board resolution, passport & ID copies, tenancy agreement or utility bill. Treat this as checklist before you even approach the bank.

- If you have foreign shareholders or parent companies abroad: get all corporate documents legalised / notarised ahead of time. Consider translation if needed.

- Prepare a clear business plan / company profile, especially if you’re a startup or have no trading history. Include projected clients, cash flow, and expected transactions.

- Choose a bank with experience handling free-zone companies or foreign-owned enterprises, they’re more likely to be flexible and faster.

- Keep shareholder and UBO data up to date. Be ready to provide full beneficial-ownership disclosures.

- If structure is complex, e.g. foreign entities, multiple shareholders, parent-subsidiary, consider engaging trusted Accounting Services, CFO Services, or VAT & TAX Consultancy Services to manage documentation and compliance.

- Ensure address proof matches trade licence address exactly (unit numbers, office numbers, floor, etc.).

- Be ready for the minimum balance requirements. Factor this into your cash-flow planning.

Scenario examples

Scenario 1: Mainland startup with foreign shareholders

A tech-services LLC gets licensed via DED. Shareholders are non-residents. They attempt corporate account opening with only trade licence, MOA and passport copies. Bank rejects application, because: (a) the shareholders were non-residents and therefore unable to provide Emirates IDs, (b) no proof of business activity or UBO declaration, (c) no UAE address proof.

What they should do: legalise passports, prepare UBO declaration, attach tenancy or office lease (Ejari), prepare a simple business plan or client LOI. Expect 6–8 weeks before account approval.

Scenario 2: Free-zone e-commerce company owned by expat

Company formed in a free zone. Owners have UAE visas and Emirates IDs. They submit trade licence, MOA, share certificates, tenancy agreement, personal bank statements, and a short business profile. Bank approves in ~3 weeks.

Key enabler: local ID + strong paperwork + clear business activity profile.

Scenario 3: Foreign branch of international company

A European parent company sets up a branch in the UAE. They submit foreign-company incorporation docs, certified translations, parent ownership documents, MOA, board resolution, passport copies of branch manager, and proof of office address (physical or approved virtual office, depending on free-zone policy). Because of extra layers (foreign ownership, parent-subsidiary structure), banks apply enhanced due diligence. Account gets approved after 8-10 weeks, with a requirement to maintain a higher minimum balance.

Closing

Here’s what really matters, being prepared. A clean file, clear ownership, valid UAE address, and a sensible business plan go a long way.

Whether you’re a mainland startup, a free-zone setup, or a branch of a foreign company, your success in getting a corporate bank account depends less on luck, more on paperwork and compliance.

If things get complex (foreign shareholders, multiple entities, non-resident signatories), it’s wise to get help from experienced Accounting Services, CFO Services or VAT & TAX Consultancy Services. That way you reduce risk of delays or rejection.

Before meeting the bank, review all documents, licence, shareholder records, UBO details, and address proofs to make sure they’re consistent. A complete file speeds up onboarding more than anything else.

Disclaimer

The information in this article is for general guidance only and is based on publicly available UAE government, regulatory, and banking sources as of 2025. Banking policies, eligibility requirements, and documentation rules may change without prior notice. Readers should verify all requirements directly with their chosen bank, relevant free-zone authority, or UAE government portals. This content does not constitute legal, financial, tax, or compliance advice. For case-specific guidance, consult qualified Accounting Services, Tax Consultants, Corporate TAX advisors, or VAT & TAX Consultancy Services in the UAE. Banks in the UAE may update their onboarding rules at any time, so always confirm the latest requirements directly with the bank or licensing authority.

Sources:

Central Bank of the UAE (CBUAE) – Customer Due Diligence (CDD) Rulebook

https://rulebook.centralbank.ae/en/rulebook/33-customer-due-diligence-0

CBUAE – AML/CFT Regulations & Guidance

https://www.centralbank.ae/en/cbuae-amlcft

CBUAE – Guidance on Digital ID for Customer Due Diligence

https://www.centralbank.ae/media/pgxibvf4/cbuae-issues-new-guidance-on-amlcft-forlfis-on-the-use-of-digital-id-for-customer-due-diligence_en.pdf

UAE Ministry of Foreign Affairs (MOFA) – Document Attestation Services

https://www.mofa.gov.ae/en/services/attestation

Emirates NBD – Business Banking Account Opening Requirements

https://www.emiratesnbd.com/en/business-banking/open-business-bank-account-online

Meydan Free Zone – Corporate Banking & Document Requirements (Free Zone Banking Guide)

https://www.meydanfz.ae/blog/how-to-open-a-business-bank-account-in-the-uae

Inlex Partners – UAE Banking Compliance Overview (KYC/AML Context)

https://inlex-partners.com/blog/a-business-leaders-guide-to-kyc-and-aml-imperatives-in-the-uae/

QuickBusinessSetup – UAE Document Attestation Steps (Process Overview)

https://www.quickbusinesssetup.com/document-attestation-in-uae/

FAQ

1. What documents are required to open a corporate bank account in the UAE?

You typically need a valid Trade Licence (mainland or free zone), Certificate of Incorporation or Company Extract, MOA/AOA (or Shareholders Agreement), Share Certificates or Share Register, Board Resolution or Power of Attorney, passport copies (all shareholders and signatories), Emirates ID (if resident), proof of UAE address (tenancy contract or utility bill), and often a business plan or company profile.

2. Can a foreign company open a corporate bank account in the UAE?

Yes, but you must submit certified or legalised foreign-company documents, demonstrate ultimate beneficial ownership, and generally meet enhanced KYC/AML scrutiny. Remote or non-resident onboarding may be possible depending on the bank, but expect more paperwork and longer timelines.

3. How long does it take to open a corporate bank account in the UAE?

If documentation is complete and structure straightforward, 2–4 weeks is realistic. For more complex ownership, foreign shareholders, or high-risk sectors, 4–8 weeks or even 6–12 weeks.

4. Which are the most common reasons for rejection of a corporate bank account application in the UAE?

Missing or incomplete documentation (address proof, share certificates, board resolution), lack of evidence of real business activity, mismatch between license address and address proof, unclear beneficial ownership structure, insufficient minimum balance, or high-risk business activity without adequate compliance.

5. Do signatories need UAE residency or Emirates ID to open a corporate bank account in the UAE?

Not always but if they are UAE-resident, banks typically require Emirates ID and visa copy. For non-resident signatories, passport copies (often notarised) plus sometimes Power of Attorney are required.

6. Do free-zone companies face additional hurdles opening bank accounts?

Free-zone companies often get approved, but banks still impose the same KYC/AML scrutiny, expect full ownership disclosure, proof of address, and sometimes more detailed business activity documentation (especially if foreign shareholders or new company).