Mainland vs Free Zone Business Setup in UAE: Which Setup Is Best?

If you’re thinking of Business Setup in the UAE, here’s the thing: both Mainland Business Setup in UAE and Business Set Up in UAE Free Zone can work brilliantly. But they solve different problems. Let’s break it down so you can decide with the facts on the table.

Table of Contents

ToggleQuick snapshot

Quick reality check

- The UAE hosts 40+ free zones across its emirates. Classifications vary so counts differ.

- DMCC reported over 25,000 registered companies in 2024.

- Corporate Tax (CT) is now law: Federal Decree-Law No. 47 of 2022. The tax regime applies for financial years starting on or after 1 June 2023 (for many companies).

When you choose where to set up, scale and what sector you’re in matter as much as speed.

Ownership and legal form: what’s different

Free zone: Almost always offers 100% foreign ownership, with legal forms such as FZ-LLC, FZE, or FZCO. Licenses are tailored to activity lists published by each zone.

Mainland: Historically required a local shareholder. Since Federal Decree-Law No. 26/2020, many activities now allow full foreign ownership, but some strategic sectors remain restricted. Always check the permitted activity list in your chosen emirate before finalising your Mainland Business Setup in UAE.

What this means: Free zones offer ownership clarity and industry clusters. Mainland licences give you full market access and eligibility for government contracts, but you must confirm activity-by-activity.

Taxes and compliance: the numbers you need

- The UAE Corporate Tax Law (Decree-Law No. 47/2022) came into effect for financial years starting on or after 1 June 2023.

- Free zone entities can benefit from preferential treatment under the “Qualifying Free Zone Person” (QFZP) rules, but only if they satisfy the FTA’s requirements: substance, permitted activities, audited financials, etc.

- The Domestic Minimum Top-Up Tax (DMTT) / OECD Pillar 2 alignment is coming in for large multinationals (global revenue threshold ~€750 million), effective 1 January 2025 for eligible entities.

- VAT thresholds: resident businesses must register if taxable supplies + imports exceed AED 375,000; voluntary registration possible at AED 187,500. (*) (Add official citation to FTA VAT rules).

(*) To insert: verify from FTA VAT registration page.

Market access and customers

Free zone: Best suited for export, trading, and sector clusters. You can import, store, and re-export goods without customs duties, but selling directly onshore usually requires a mainland license, a local distributor, or a registered branch.

Mainland: Lets you trade directly with UAE customers, bid for government contracts, and participate in tenders. This access is the single biggest advantage of an onshore license.

Operations: visas, offices, and setup

Free zones often provide flexible options, from flexi-desks to virtual offices, with visa quotas tied to office space or license type. Mainland licences usually require a physical trade address under local Department of Economy and Tourism rules.

Regardless of your route, early planning for finance and compliance is critical. Outsource to CFO Services or rely on professional Accounting Services to avoid penalties.

Value capture and tenders (ICV)

If you want to bid for government or major oil & gas tenders, ICV Certification is essential. ADNOC’s program has expanded into a nationwide initiative led by the Ministry of Industry & Advanced Technology (MoIAT). Planning for local procurement and Emiratisation from the start helps strengthen your ICV score.

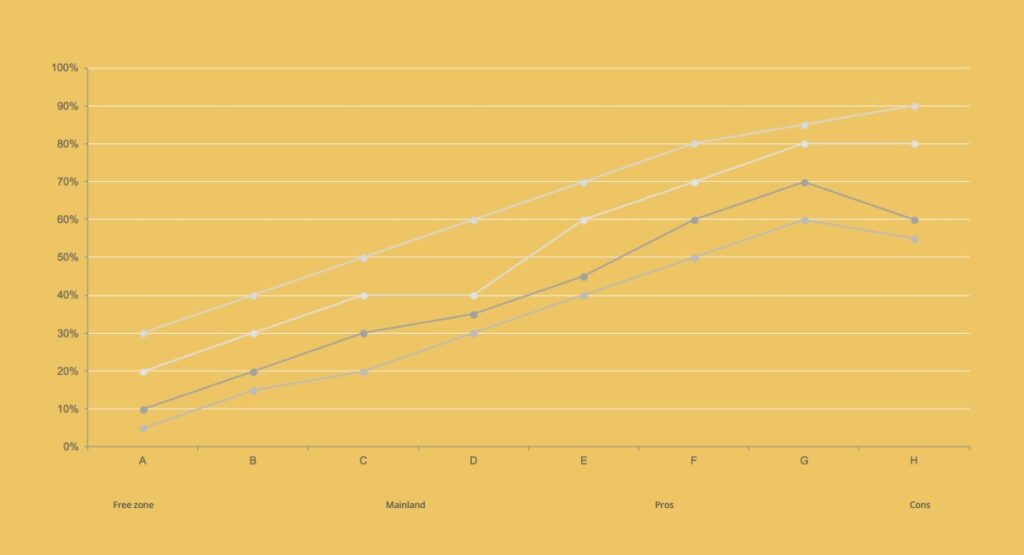

- Pros and cons – short checklist

| Route | Pros | Cons |

| Free zone | ✅ 100% foreign ownership ✅ Sector-focused ecosystems ✅ Often faster setup | ❌ Limited direct mainland trade❌ Must meet Free Zone Person / substance & compliance rules❌ Zero-tax assumptions risky if rules not met |

| Mainland | ✅ Full market access✅ Eligible for government contracts✅ More flexible trade across UAE | ❌ Licensing complexity varies by emirate❌ Ownership rules depend on activity❌ More regulatory/compliance overhead sometimes |

Practical next steps

- Pick your business activity and check whether it is permitted where you plan to set up (mainland DED/Department of Economy, or your target free zone authority).

- Confirm which financial year your company uses so you know when CT applies.

- Check whether your free zone entity can be a Qualifying Free Zone Person under FTA rules. Read the FTA “Free Zone Persons Guide (CTGFZP1)” for details.

- If you aim for government tenders / ICV, start certification early.

- Budget for accounting, auditing, compliance support—CT and VAT are ongoing.

- Understand exit costs: company liquidation, evaluation, legal fees under new and existing laws.

What to ask your advisor

Here are key questions to bring up when you meet your consultant:

- Is my chosen activity eligible in the free zone or mainland for 100% ownership?

- For my financial year period, from when does Corporate Tax apply to me?

- Can my free-zone entity qualify as a “Qualifying Free Zone Person” (meeting substance, permitted/excluded activities, etc.)?

- What VAT rules and registration thresholds will apply to me?

- Will I need ICV certification or local procurement/emiratisation for the tenders I target?

- What are the full costs, process, and timeline for company exit / liquidation?

- Should I outsource CFO / accounting / compliance, or set up in-house?

Conclusion

Both routes can be strong. Free zones give ownership clarity, specialization, and often faster initial setup. Mainland gives better market access, eligibility for government contracts, broader trade reach. What matters is where your customers are, whether you want government business, and how much compliance you’re ready to handle.

Make your choice based on:

- Where your customers will be (local, regional, export)

- If government contracts or tenders matter

- How tax, documentation, and substance requirements will affect your operations

Use the official sources (FTA, MOF, DMCC, MoIAT, your free zone authority) to guide those decisions. That’s how you execute from a place of strength.

Disclaimer: This article is for general informational purposes only and does not constitute legal, financial, or tax advice. Regulations in the UAE, including corporate tax, VAT, and foreign ownership rules, are subject to updates and may differ across emirates and business activities. Always verify the latest requirements directly with official authorities such as the Federal Tax Authority (FTA), UAE Ministry of Finance, or your chosen free zone/mainland licensing authority. For decisions on setup, tax compliance, or certification, consult a licensed business consultant, tax advisor, or legal professional in the UAE.

Sources:

- Federal Tax Authority – Free Zone Persons Guide (CTGFZP1) / requirements for Qualifying Free Zone Person. KPMG+3Federal Tax Authority+3DLA Piper+3

- DMCC Annual Report 2024 – total registered companies, new registrations. DMCC

- UAE Official Portal (u.ae) – Corporate Tax information, applicable entities. UAE Official Portal

- OECD / international coverage – Domestic Minimum Top-Up Tax (Large multinationals) effective January 2025. Reuters+1

- DMCC

- Federal Tax Authority+1

FAQ

1. What are the main differences between starting a business in a Free Zone vs Mainland in the UAE?Free zones give you 100% foreign ownership, sector-focused ecosystems, and easier import/export handling. But if you want to sell directly to customers in the UAE or bid for government contracts, you’ll need a mainland licence. Mainland companies give you full market access across the UAE, but ownership rules depend on your chosen activity and emirate.

2. Which is cheaper to set up: a Free Zone company or a Mainland company in the UAE?

Free zones often look cheaper at the start because packages can bundle licences, office space, and visas. But costs depend on the free zone and activity type. Mainland setup may have higher upfront costs (trade name, licence fees, office lease), yet it can save you distributor fees if your customers are local. The real cost depends on your activity, visa needs, and growth plans, not just the initial licence fee.

3. Can a Free Zone company switch to Mainland?

Yes, but not directly. A free zone company can’t simply “convert” into a mainland company. Instead, you’d need to establish a new mainland entity (or branch) and transfer operations, assets, or licences as needed. The process involves approvals from the Department of Economy in the emirate plus clearance from your free zone. It’s doable, but requires planning for costs, contracts, and employee visas.

4. What are the office space and visa requirements for businesses in Free Zones vs Mainland?

- Free Zones: Most offer flexible options, from “flexi-desks” and shared spaces to full offices. The number of visas you can sponsor usually ties to the office size or package you choose.

- Mainland: A physical office or workspace is generally mandatory, and visa quotas are linked to office size and approval from the Ministry of Human Resources & Emiratisation. Mainland rules are stricter on physical presence than many free zones.

5. Which business setup is better for startups targeting the UAE local market: Free Zone or Mainland?

If your core customers are inside the UAE, especially retail or services, a mainland setup makes more sense, you can sell directly and compete for government or corporate tenders. Free zones suit startups focusing on exports, e-commerce, or global trade where UAE is a base rather than the main customer market.

6. Are there audit requirements for Free Zone versus Mainland companies?

Yes. Many free zones require companies to submit audited financial statements annually, especially to maintain compliance for tax and “Qualifying Free Zone Person” status. Mainland companies may not always require annual audits for smaller entities, but banks, investors, and tax authorities often expect them. With Corporate Tax now in force, both free zone and mainland businesses should prepare audited accounts to stay compliant.