FZE vs. FZCO: Which Free Zone Setup Fits Your Business in the UAE?

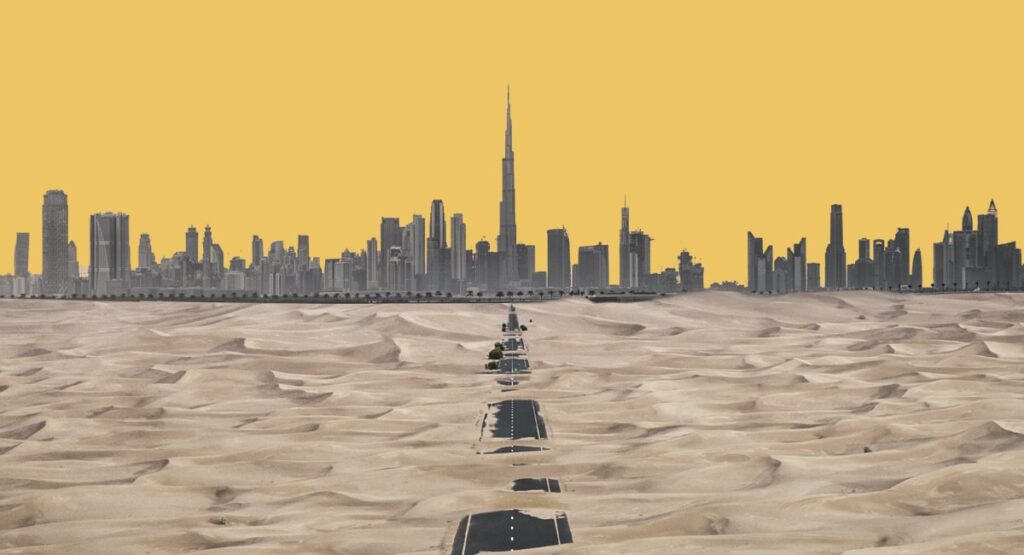

Thinking of launching your business in the UAE? You’re not alone—and honestly, who could blame you? With its prime location bridging East and West, business-friendly vibes, and modern infrastructure, the UAE has been reeling in entrepreneurs from around the world for years now.

One of the most attractive things about starting up here? The free zones.

These special business areas come with perks like 100% foreign ownership, tax breaks, and a much smoother business setup process than you’d typically expect elsewhere. But—and it’s a big but—if you’re eyeing one of these zones, there’s an early decision you’ve gotta make: should you go with an FZE or an FZCO?

They might sound similar (and to be fair, they kind of are), but they serve different purposes and offer distinct advantages depending on your business model. Let’s break them down.

Table of Contents

ToggleSo, What Exactly Is an FZE?

An FZE—short for Free Zone Establishment—is a type of legal entity meant for solo acts. Think one-man shows, freelancers, consultants, or a single corporation wanting full control.

In plain terms: if you’re the only one calling the shots, this is probably your jam.

The best part? It’s a limited liability setup. That means your personal assets stay safe if things don’t go as planned (which, let’s face it, is something every entrepreneur wants to hear). Plus, with no partners to consult or boards to appease, decisions happen fast. You’re the captain, the crew, and the navigator.

A few zones that roll out the red carpet for FZEs include DMCC (Dubai Multi Commodities Centre) and JAFZA (Jebel Ali Free Zone)—some of the big names in the UAE’s business ecosystem.

Meet the FZCO: The Collaborative Route

Now, let’s talk about FZCO, or Free Zone Company. If FZEs are for solos, FZCOs are the team players. This structure allows for multiple shareholders—anywhere from two all the way up to fifty. These could be individuals, companies, or a mix of both.

So if you’re building something with partners, investors, or planning a joint venture, FZCO is built for that.

Just like FZEs, FZCOs also come with limited liability protection. The difference is in how decisions are made. With more people involved, there’s usually a more formal governance process—maybe a board of directors, regular votes, that kind of thing. It adds a layer of structure, which can be a good thing when you’re managing different voices and visions.

Popular zones for FZCOs? Look at places like Dubai Silicon Oasis (DSO) and DAFZA (Dubai Airport Free Zone). Both are excellent hubs for tech and innovation-focused businesses.

FZE vs. FZCO: A Head-to-Head Breakdown

At a glance, they both offer great benefits. But the devil, as always, is in the details.

Ownership

- FZE: One owner.

- FZCO: Two to fifty shareholders. Great for partnerships.

Decision-Making

- FZE: Quick, simple, and solo-driven. You make the calls.

- FZCO: Shared decisions. More structure, more accountability.

Flexibility

- FZE: Ideal for lean, self-managed businesses.

- FZCO: Easier to scale, take on investors, and pivot down the road.

Capital Requirements

- Varies by zone, but FZCOs sometimes come with higher capital requirements—understandably, since you’ve got more moving parts and players involved.

How Do You Choose?

Honestly? It depends on your game plan.

Are you going it alone with a consulting gig or a service-based model that doesn’t need outside funding or partners? FZE could be your perfect match—streamlined, straightforward, and all yours.

But if you’ve got partners, co-founders, or investors in the picture—or plan to bring them in later—then FZCO gives you the structure you’ll eventually need. It’s more future-proof that way.

Also think about things like:

- How much admin do you want to deal with? FZEs are quicker to set up and manage.

- What kind of business license do you need? Some zones only allow certain licenses (like multi-sector trading) under an FZCO.

*Licensing requirements vary across free zones and depend on the specific business activity. It’s advisable to consult the respective free zone authority for accurate information. - Are you ready for compliance responsibilities? Each zone has its own rulebook, so get familiar with it early.

Why Free Zones Are Still a No-Brainer

Regardless of which route you take, setting up shop in a UAE free zone is loaded with advantages:

- 100% foreign ownership (that’s still a huge win)

- No corporate or personal income tax (in most zones)

*As of June 1, 2023, the UAE implemented a federal corporate tax of 9% on business profits exceeding AED 375,000. However, qualifying free zone entities may still benefit from tax exemptions under certain conditions. - You keep all your profits—no hidden strings

- Faster setup thanks to built-in support teams and streamlined bureaucracy

- Prime location if you’re aiming for global trade

In short, it’s a high-growth environment in a region that’s ready to start a business setup.

Conclusion

Here’s the truth: there’s no one-size-fits-all answer. Whether you go with an FZE or FZCO depends entirely on what you’re building—and who you’re building it with.

If control and simplicity are your top priorities? FZE all the way.

But if you’re setting the stage for a more collaborative or scalable operation? FZCO’s got the tools to grow with you.

Either way, you’re setting up a mainland business setup in UAE or in free zones—it’s hungry for it. That alone makes it worth doing right. And if you’re not 100% sure which path is best, looping in a legal or business setup expert who knows the local landscape can save you from costly missteps.

You’ve got the vision. Now choose the structure that helps you build it right.

Disclaimer: This content is for informational purposes only and does not constitute legal, financial, or immigration advice. Please consult an official government source or licensed advisor for the most up-to-date requirements.

References and Sources

- UAE Government Portal – Starting a Business in a Free Zone

- Dubai Multi Commodities Centre (DMCC) – Business Structures

- Jebel Ali Free Zone (JAFZA) – Setup Guide

- Dubai Airport Free Zone (DAFZA)

- Dubai Silicon Oasis (DSO) – Business Setup

- MSZ Consultancy – FZE vs FZCO Guide

FAQ

1. How many shareholders can an FZCO have compared to an FZE?

An FZCO (Free Zone Company) offers flexibility when it comes to ownership. It can be formed with a minimum of two and a maximum of fifty shareholders, making it a suitable structure for joint ventures, partnerships, or businesses expecting future investors. On the other hand, an FZE (Free Zone Establishment) is strictly a single-shareholder entity—it’s designed for those who want to go solo, either as an individual or a corporate owner. So, if you’re planning to build a collaborative business, FZCO gives you room to grow.

2. Which is better for solo entrepreneurs: FZE or FZCO?

The Free Zone Establishment (FZE) is obviously the winner for solo startups. It is designed for people or sole companies seeking complete business control free from board approvals or partner agreement. The FZE appeals mostly for its simplicity of setup, autonomy in decision-making, and limited liability protection. Although a FZCO can theoretically comprise just two shareholders, it is more appropriate for companies with several voices and shared duties. FZE allows you the flexibility to lead without compromise if you are constructing your dream solo.

3. Can an FZE be converted into an FZCO later?

Indeed, most free zones allow one to transform a FZE into a FZCO; the process depends on the guidelines and approval of the particular free zone authorities. Usually, this conversion happens when an individual entrepreneur chooses to bring investors or partners. It entails changing the license of the business, altering the shareholder agreements, and maybe changing the financial structure. Although the procedure is somewhat simple, it does call for legal documentation and compliance inspections; hence, expert help is advised to guarantee a seamless flow.

4. Do FZEs and FZCOs offer the same tax benefits in UAE free zones?

Yes, the UAE free zones FZEs and FZCOs have exactly the same tax benefits. Whether you run a single entity or a multi-shareholder corporation, you can gain from 100% corporate tax exemption (in most free zones) (note: subject to meeting qualifying conditions under UAE’s federal tax law), zero personal income tax, and complete repatriation of profits and capital. Your company’s structure—FZE, or FZCO—has no bearing on your eligibility for these incentives. Still, it’s crucial to keep current on changing tax laws, particularly given UAE corporate tax rules that might apply to specific thresholds recently introduced.

5. What factors should I consider when choosing between an FZE and an FZCO?

Choosing between an FZE and an FZCO comes down to the nature of your business and long-term vision. Here are a few key questions to help guide your decision:

Are you starting solo, or do you have partners/investors from day one?

Do you anticipate bringing in additional shareholders in the near future?

How much control do you want over decision-making?

What is your budget for setup, compliance, and governance?

If you’re flying solo and want quick, uncomplicated setup and control, an FZE is ideal. But if your business is built on collaboration or has scalable ambitions involving multiple stakeholders, the FZCO is a more future-proof structure. The choice isn’t just about the present—it’s about where your business is headed next.